Australia, like Iceland as we wrote about yesterday, is an expensive place to

fly to. While Iceland is expensive because not a lot of airlines fly there,

Australia is expensive because it’s just so darn far away. Luckily for us points

collectors though, this doesn’t matter. Using miles to travel to Australia is

one of the most valuable redemptions available. Plus, with many airlines, we

can add in a free stopover somewhere else on the way! Here’s our proposed

itinerary:

Chicago to Sydney

Sydney to Singapore

Singapore to Chicago

And the credit cards we’ll be signing up for:

Chase United Explorer

35,000 points after $1,000 spend in 3 months

No annual fee first year

Chase Ink Bold

50,000 points after $5,000 spend in 3 months

No annual fee first year

The Chase Ink Bold is a business credit card, but even if you just sell

things on eBay sometimes, you technically have a business. You can sign up using your

social security number as the federal tax ID that the application requires.

Million Mile Secrets has a great

post on the details of having a business even as an individual.

Total Miles: 31,000

Total General Points: 55,000

Total Cost: $0

Flights

My favorite thing about Chase Ultimate Rewards points is the ability to

transfer to transfer them to United Airlines, since I love United miles. They

transfer at 1:1 ratio, and a ticket to Australia costs 80,000 miles, so we’ll

need 49,000.

United allows a free stopover on any international trip, which means I

can stop somewhere on the way to or from Sydney. One of the nicest airlines in

Star Alliance happens to be Singapore Airlines, so I figure why not add in a

stopover there. United’s website is very good at showing me their and most of

their partners’ award availability. I can search all three segments of this

trip at once too:

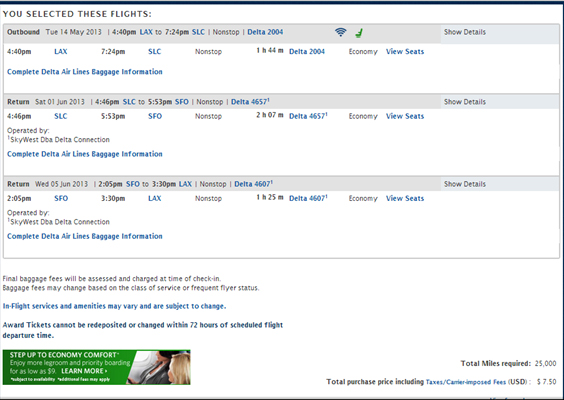

After a bit of looking around for good flights, I come up with this

itinerary:

And the price?

Not bad for two different continents! Plus

I get a 10-hour layover in Beijing which would probably give me about 6 hours

in that city if I wanted it.

Total Points Used: 80,000

Total Cost: $176.60

Granted, you’re going to have to pay for your own hotels, but those pale

in comparison to the cost of actually getting to these two continents. You

could also sign up for the Barclays Arrival card or the Amex Gold card to get

points towards hotels. However the two credit cards mentioned above will be

enough for your flights.

Here’s a look at the actual price for flights on the same days:

Flights

$3002

Total Savings: $3,002

Need help thinking about the right credit cards for you, or how to book

this kind of trip? Head over to www.wennecorp.com

and we’d be happy to chat with you.

Credit Card Links

United

MileagePlus Explorer (make sure to add an authorized user in order to get

to 35,000)